Up to 75% of claim denials stem from eligibility issues that could have been prevented with proper verification before patient appointments. This single statistic explains why eligibility and benefits verification has become a critical focus for medical practices struggling with denied claims and delayed payments.

The problem extends beyond denied claims. When practices skip thorough verification, they face payment delays, administrative rework, patient frustration, and revenue loss. Eligibility and benefits verification services address these challenges by ensuring insurance coverage is confirmed before patients receive care.

Understanding Eligibility and Benefits Verification

Eligibility and benefits verification involves confirming that patients have active insurance coverage for scheduled appointments and understanding what that coverage includes. This process goes beyond simply checking if a patient has insurance.

The verification process includes:

- Verifying coverage effective dates

- Confirming the patient’s plan is active on the service date

- Identifying patient financial responsibilities

- Determining if services require prior authorization

- Confirming provider network status

Many practices attempt to handle verification internally, but the process consumes significant staff time while producing inconsistent results. Front desk personnel juggling phone calls, appointment scheduling, and patient check-in struggle to complete thorough verifications. The result? Denied claims, surprise bills for patients, and revenue cycle disruptions that affect practice cash flow.

Professional eligibility and benefits verification services specialize exclusively in this process, bringing expertise, technology, and systematic approaches that produce more reliable results.

The Complete Verification Process

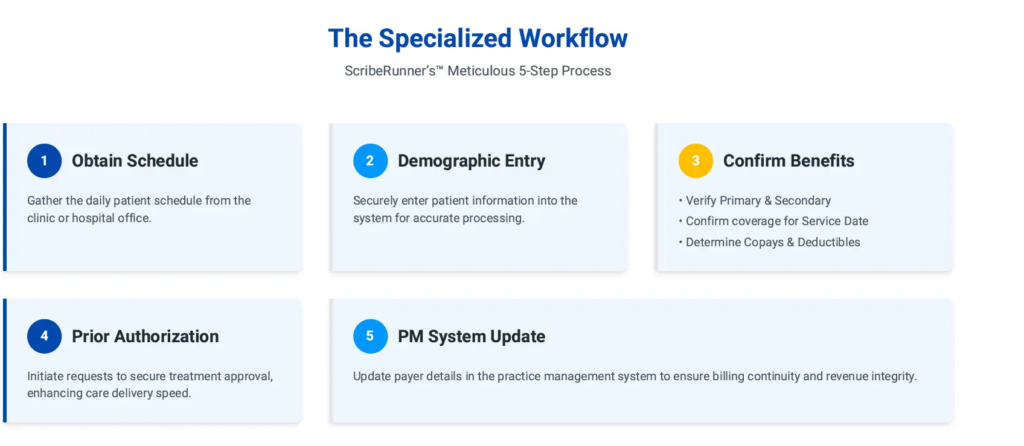

Step-by-Step Workflow

Schedule Receipt: The verification service receives the upcoming appointment schedule from the practice, typically 3 to 5 business days before scheduled visits. This advance notice allows time for thorough verification and prior authorization processing if needed.

Demographic Entry: Patient information including full name, date of birth, insurance ID numbers, and service dates, is entered into verification systems. Accurate data entry prevents verification errors that could affect claim submission.

Primary Insurance Verification: Specialists contact the primary insurance carrier to verify active coverage on the scheduled service date, confirm the patient’s plan and policy details, identify coverage limitations or exclusions, determine copayment amounts, check deductible status and remaining amounts, and confirm coinsurance percentages.

Secondary Insurance Check: When patients have secondary coverage, the process repeats to understand coordination of benefits, identify which insurance pays first, and determine secondary coverage details.

Patient Responsibility Identification: Based on coverage details, the service calculates expected patient financial responsibility, including copayment amounts due at service, deductible balances, coinsurance percentages, and any non-covered services the patient will pay for entirely.

Providing this information before appointments allows practices to collect payments at the time of service rather than billing patients afterward, improving cash flow and reducing bad debt.

Prior Authorization Assessment: The verification process identifies services requiring prior authorization from insurance companies. When authorization is needed, the service initiates the request immediately, tracking approval status through completion.

System Updates: Once verification is complete, patient insurance information is updated in the practice management system with correct payer details, current coverage information, authorization numbers when applicable, and patient responsibility amounts.

Reporting: Practices receive clear reports showing verification status for each patient, any issues requiring attention, authorization status for services requiring approval, and patient financial responsibility estimates.

Common Verification Challenges

Insurance Card vs Actual Coverage: Patients often present cards showing old policy numbers or terminated coverage. Visual inspection doesn’t confirm active coverage. Professional services contact insurers directly to verify current status.

Complex Coverage Rules: Modern plans include network requirements, referral needs, pre-certification mandates, and coverage limitations. Verification specialists trained in insurance requirements recognize these complexities before they cause denials.

Multiple Insurance Coordination: Patients with multiple policies require coordination of benefits. Incorrect coordination causes claim delays and rejections.

Time-Consuming Process: Thorough verification takes 15 to 30 minutes per patient. For practices seeing 30 patients daily, this consumes 7.5 to 15 staff hours every day, often proving impossible alongside other front office responsibilities.

Benefits of Professional Verification Services

Reduced Claim Denials

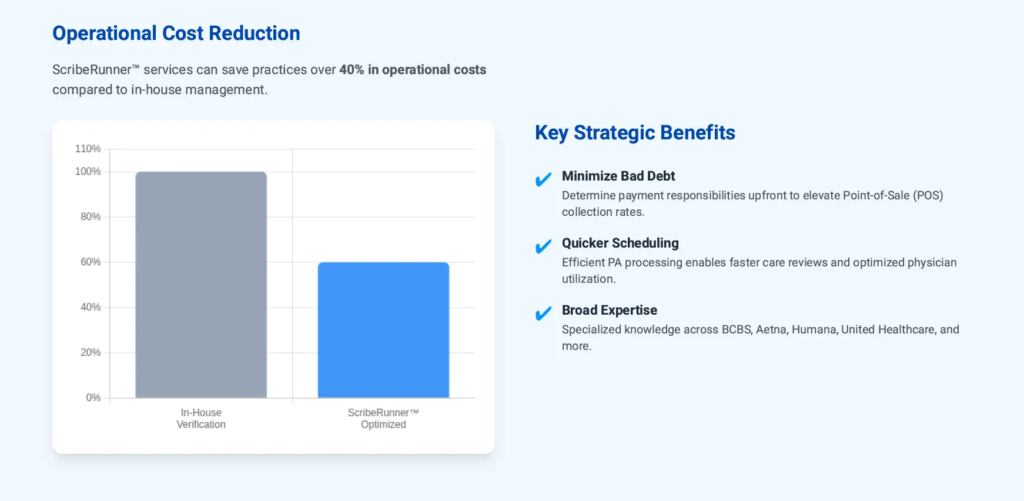

Comprehensive pre-visit verification dramatically reduces denials from eligibility issues. When verification processes are optimized, practices experience significantly fewer eligibility-related denials, saving the administrative cost of denial management, resubmission, and potential payment loss. The financial impact compounds across hundreds of claims monthly.

Improved Cash Flow

Knowing patient financial responsibility before appointments enables point-of-service collection. Practices collect copayments, deductibles, and coinsurance at check-in rather than billing patients afterward.

This shift improves collections rates significantly. Studies show that practices collect substantially more when payments are taken at the time of service compared to billing patients after appointments. The difference directly affects practice cash flow and reduces bad debt.

Reduced Administrative Burden

Outsourcing verification frees practice staff for other critical tasks including patient check-in and support, appointment scheduling, clinical assistance, and practice management.

The time savings allows practices to operate efficiently without adding staff or extends capacity to see more patients without increasing administrative overhead. Professional services can save practices over 40% in operational costs compared to managing verification in-house.

Enhanced Patient Experience

Patients appreciate knowing their financial responsibility before appointments. This transparency allows them to plan for costs, understand their insurance benefits, avoid surprise bills, and make informed decisions about care timing.

Clear communication about costs before service delivery improves patient satisfaction and reduces billing complaints.

Faster Prior Authorization Processing

When services require authorization, early verification allows time to obtain approvals before appointments. This prevents last-minute appointment cancellations, treatment delays, and patient frustration.

Authorization processing typically takes 3 to 10 business days. Starting the process immediately after appointment scheduling ensures approvals are in place when patients arrive.

Summary: The Benefits of Proactive Verification

| Benefit Category | Key Outcome | Real-World Impact |

| Patient Trust | Eliminates surprise bills and provides clear cost transparency | Patients know what they’ll owe before receiving care |

| Office Atmosphere | Reduces wait times and friction at the front desk | Check-in becomes a welcoming experience |

| Staff Efficiency | Reclaims hours previously spent on hold with payers | Your team focuses on patient care instead of phone trees |

| Clinical Continuity | Prevents rescheduled appointments due to missing authorizations | Treatment happens on schedule |

| Data Integrity | Ensures patient records are accurate and up to date | Cleaner billing, faster payments, fewer errors |

| Financial Performance | Improves point-of-service collections and reduces denials | Money comes in faster with less effort |

Specialties Served

Eligibility and benefits verification services support practices across medical specialties including:

- Radiology and Imaging Centers

- Cardiology

- Orthopedics

- Pain Management

- Oncology

- Neurology

- Gastroenterology

- Dermatology

- Internal Medicine

- Family Medicine

- Primary Care

Services scale effectively across practice sizes. Solo practices benefit from expertise without hiring dedicated staff. Small groups (2-5 providers) achieve consistency across providers. Large practices (6+ providers) scale verification without proportional staff increases.

Implementation and Selection

Implementation typically takes 2 to 4 weeks involving secure system access, sharing scheduling protocols, identifying verification requirements, and staff training.

Once operational, practices send schedules, receive verification reports before appointments, update patient records, and collect responsibilities at check-in.

When selecting a service, evaluate experience with your specialty, technology integration capabilities, turnaround times, authorization processing, reporting quality, and references from similar practices.

Making the Decision

Eligibility and benefits verification services benefit virtually all medical practices, but particularly those experiencing:

- High rates of eligibility-related denials

- Difficulty collecting patient payments

- Staff overwhelmed with verification workload

- Inconsistent verification quality

- Frequent authorization delays causing appointment cancellations

Practices with very low patient volumes (under 10 daily) should carefully evaluate cost-effectiveness, though quality and consistency still favor professional services.

The decision ultimately balances service cost against prevented denials, improved collections, and staff efficiency gains. For most practices, professional verification services deliver substantial positive returns while improving practice operations and patient satisfaction.

ScribeRunner’s Eligibility and Benefits Verification Services

ScribeRunner provides comprehensive eligibility and benefits verification services for medical practices nationwide. Our specialized team ensures accurate verification before every appointment, reducing denials and improving cash flow.

Based in Miami, Florida, we serve practices throughout the United States across all major specialties including Radiology, Cardiology, Orthopedics, Pain Management, Oncology, Neurology, Gastroenterology, Dermatology, Internal Medicine, Family Medicine, and Primary Care.

Eligibility and Benefits Verification Services include:

- Pre-appointment insurance verification

- Primary and secondary coverage confirmation

- Patient financial responsibility calculation

- Prior authorization processing

- Practice management system updates

- Comprehensive verification reporting

Key Benefits:

- Reduction in eligibility-related denials

- Significant improvement in point-of-service collections

- Over 40% savings in operational costs vs in-house staff

- Enhanced patient satisfaction and transparency

Contact ScribeRunner:

- Phone: (786) 866-7849

- Address: 25 SE 2nd Ave, Suite 550 #2016, Miami, FL 33131

- Hours: Monday through Friday, 8 AM to 6 PM EST

- Service Area: Miami, Fort Lauderfort, Tampa, Orlando, and nationwide

- Pricing: Starting at $1,995/month per resource